The European e-commerce markets share many similarities as well as numerous differences. Companies hoping to develop their online sales in several European countries find themselves confronted by a variety of challenges. Technical questions such as the formation of an international SEO strategy all too often remain unanswered. Here is our advice for efficiently managing the different currencies and payment methods on your international e-commerce site.

1. Currency dilemma

First, online retailers must make online shoppers feel at home. The navigation should be easy, in their native language with adapted imagery and localized currency. These elements produce trust – a key factor in cross-border conversion.

Use of local currencies has been confirmed to result in higher sales and is mandatory for online retailers who want to sell on places like Google Shopping.

Online retailers should be cautious when choosing the currency for European sales: they have the choice of using the Euro or a local currency. However, these two options involve different risks: using the Euro makes it easier for shoppers to compare prices from one website to another, which can be disadvantageous for retailers online retailers with significant price differences. On the other hand, using the local currency can carry the risk of exchange rate fluctuations during an economic crisis. Apple faced this problem in Russia when the Ruble experienced massive fluctuations, which resulted in the decision to stop selling products on the Russian website.

2. Payment methods

It is often assumed that credit cards are the best and only way to accept payment for online purchases – but this is only partly true. While it is the most popular payment method in Europe (used by 72% of Europeans), there are other payment methods that count in some countries.

Alternative payment methods

Guillaume Princen, Head of France & Southern Europe at Stripe, explains the latest innovations in payment solutions available to online retailers. Stripe is a payment platform that combines big data and learning machine technology to give customers an anti-fraud solution while providing a seamless experience.

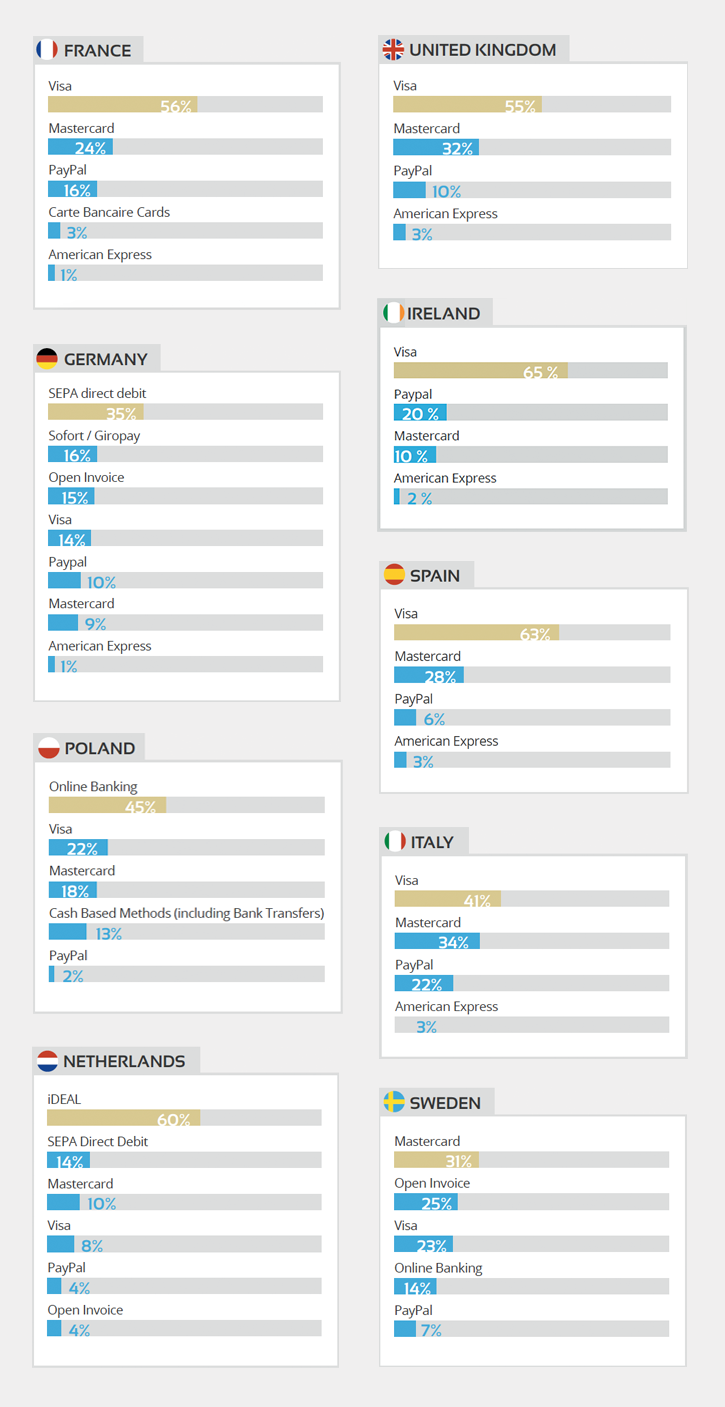

Alternative payments can be defined as all payment solutions that do not involve credit cards, such as online wallets (Bitcoin or PayPal for example) and bank transfers. It is essential for merchants to offer these alternatives in order to attract cross-border sales. European consumers generally prefer PayPal, but local players are gaining popularity, such as iDeal in the Netherlands (60%) and Sofort in Germany (16%). If online retailers offer the right combination of options for customers, this can lead to higher conversion rates and sales. Online retailers should also stay up to date with the latest innovations in payment methods as these often provide an improved user experience while reducing costs for online retailers.

Mobile payment

As mobile shopping becomes the norm in Europe, online retailers need to ensure that their payment methods are also mobile-friendly. A good way to do this can be to develop a custom mobile app, which can also serve as an extra distribution channel with a high reach potential.

A successful mobile user experience involves a limited amount of scrolling, number of pages and steps while shopping, especially during the payment process. Online retailers can use payment platforms like Stripe or integrate solutions like Apple Pay or Android Pay, in order to offer one-click-buy options in order to simplify the process, thereby increasing conversions.

All these payment methods are meant to achieve one goal: creating a seamless shopping experience that contributes to a successful international expansion strategy.

Preferred online payment methods by country

Even though the European Union is trying to build a single digital market, there are still significant differences in payment preferences in each member state. For example, shoppers in countries like Netherlands and Germany prefer non-credit card payment systems such as iDeal and Sofort.

Online payment methods should be adaptable to different channels, devices and countries; however, online retailers should be cautious with their approach. Too many payment methods can be too much to handle and credit cards are still one of the most popular worldwide options.

3. Fraud

While consumers are fairly used to online shopping, the fear of fraud still exists for many, especially for overseas purchases. Online retailers need to address this fear and instil a sense of trust in shoppers without degrading the shopping experience.

As online shopping is increasing, the risk of online fraud is also growing and affecting consumer behaviour. Recent reports have shown that 62% of consumers who didn’t buy from international online shops said that they were hindered by the fear of fraud, such as stolen credit card details or misused personal data.

Expectations towards security can be quite different across countries. As an example, in the UK, 40% of smartphone users do not purchase through the device because they don’t find it secure. This is less prevalent in Germany and Belgium, where only 25% feel this way. Retailers must clearly understand how customers want to shop online and what type of security they expect.

One solution for combatting payment fraud is the use of 3D Secure payment security. On a global scale, the results of this solution have differed across countries and local preferences. The impact is positive on conversion rates in Russia and India but judged quite negative in France, Germany, Brazil, China and the USA where the process increased shopping cart abandonment rates (especially on mobile).

Online retailers must adapt their antifraud strategy to every market based on the risks, the steps of the payment process and the type of payment method.

Some payment platforms (e.g., Stripe) have developed advanced fraud protection tools, which rely on state-of the art machine learning technologies (analysis of every single transaction based on historical statistical data), which makes them invisible for end customers, and therefore provide a frictionless purchasing flow, thereby maximizing conversion rates while reducing fraud.

In the long run, fraud can result in lost customers and bad publicity, which is incentive enough for retailers to look at the latest solutions on the market that offer a more streamlined experience while providing advanced fraud protection.

Check out all of our advice in the ultimate guide to online cross-border sales in Europe, created in partnership with Lengow!